PMM

Mr. Hemsi, due to the volatile economic and political circumstances, we must first ask: Can you guarantee the supply of raw produce - from peppers and chillies to tomatoes and capers - next season?

Moiz Hemsi

Yes! Thanks to the expansion of contracted plantings and the promotion and support of growers. In the 2022 planting/decision period, the cost of growing tomatoes and peppers doubled to tripled. Alternative crops, especially cotton, promised high yields. For that reason, many farmers had switched to growing cotton and reduced planting of tomatoes and peppers. Now, at harvest time, farmers are disappointed with cotton prices falling again and satisfied with the yields from peppers and tomatoes. For the coming season, I can already say that the market will take this into account and increase the cultivation of peppers and tomatoes.

Do you expect any shifts in supply or prices?

As I said, I expect increased planting of tomatoes and peppers. As a result, prices may fall, but not sharply, as farmers need to cover their costs. Unfortunately, the cost of growing vegetables has continued to rise. However, I hope that the cost factors will decrease again, which would have a positive impact on the overall price level.

How do you deal with the unrestrained inflation in Turkey?

When inflation was local, i.e. only in Turkey, it was easier because the devaluation of the Turkish lira compensated for inflation. That doesn't work now, because the current inflation is a global problem. I'm afraid we have no other option but to increase productivity and lower profit margins to compensate for the increase caused by global inflation.

What impacts do you feel from the climate change?

Climate change poses the most serious and unpredictable threat to all who work in the agricultural sector. Farms are roofless factories and plants are sensitive living creatures. Any unusual weather conditions will affect crops and therefore yields.

In difficult times, partnerships between supplier and importer have to prove their worth. How do you view the long-standing cooperation with Paul M. Müller? Do you have any special wishes?

It is very important to have a loyal partner in such difficult times. We are delighted about our long-standing collaboration with Paul M. Müller and would like to expand our cooperation further. Last Word: One hand washes the other and both hands wash the face...

Thank you very much for the open conversation.

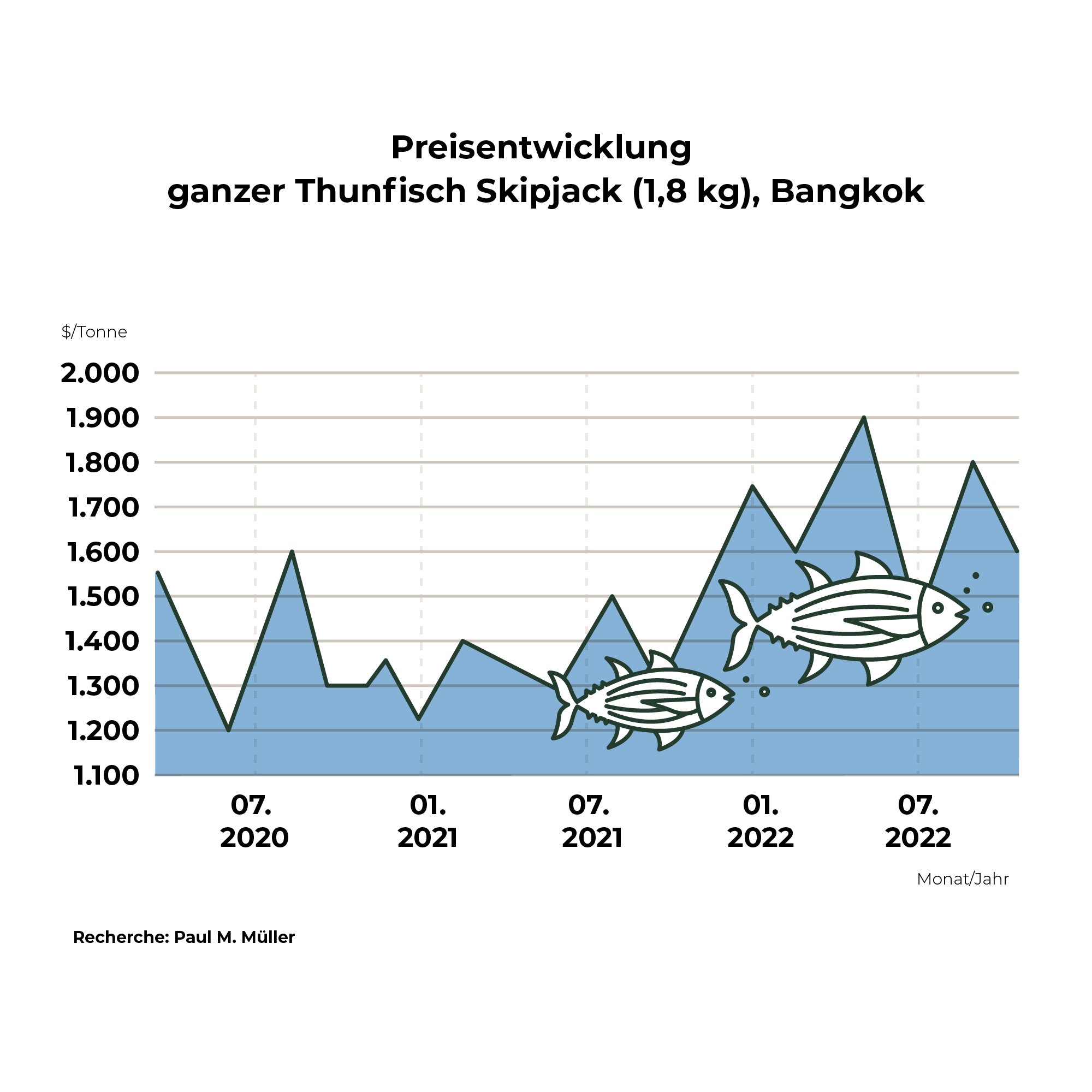

The demand for raw product is currently limited, as producers in Thailand are counting on lower prices for frozen goods after the end of the FAD ban. It is uncertain whether these speculations will prove to be true.

The demand for raw product is currently limited, as producers in Thailand are counting on lower prices for frozen goods after the end of the FAD ban. It is uncertain whether these speculations will prove to be true. "I think it's pretty cool what PMM is doing with tuna and how high the requirements are for ADRIA quality at the source. Thanks to the excellent contacts, some of whom have been around for decades, I'm getting to grips with the new subject matter very well and it's also a lot of fun 😊. Especially because I'll have Martina by my side until next year. I'm literally soaking up her mega experience."

"I think it's pretty cool what PMM is doing with tuna and how high the requirements are for ADRIA quality at the source. Thanks to the excellent contacts, some of whom have been around for decades, I'm getting to grips with the new subject matter very well and it's also a lot of fun 😊. Especially because I'll have Martina by my side until next year. I'm literally soaking up her mega experience."

However, the run on the high-quality and popular product remains strong: "The demand for tomato products has not - as expected by some - collapsed again," explains a long-time insider to PMM, "on the contrary, it is still very high". Industry and gastronomy are still looking for a lot of the best produce.

However, the run on the high-quality and popular product remains strong: "The demand for tomato products has not - as expected by some - collapsed again," explains a long-time insider to PMM, "on the contrary, it is still very high". Industry and gastronomy are still looking for a lot of the best produce.

And secondly, because the growth in pineapple for processing factories in 2022 will be plus 14% compared to the previous year, according to the Thai industry association TFPA. This means that more than 1.25 million tons of fresh pineapple will arrive at processing plants this year (2021: around 1.1 million tons). This already includes the volumes from the current winter harvest, which started in October and runs until February 2023.

And secondly, because the growth in pineapple for processing factories in 2022 will be plus 14% compared to the previous year, according to the Thai industry association TFPA. This means that more than 1.25 million tons of fresh pineapple will arrive at processing plants this year (2021: around 1.1 million tons). This already includes the volumes from the current winter harvest, which started in October and runs until February 2023.

Watch out: Christmas is coming sooner than expected. The last loading opportunity this year from our central warehouse in Hamburg is 23.12.2022. After that, operations in the Hanseatic city will start again from 2 January 2023. In Italy, many suppliers close in the post-Christmas week until 8.1.2023. The first direct deliveries after the plants open will only be possible again then. In terms of delivery via Hamburg or drop shipments, we ask you to plan enough in advance and notify us in good time. Then you will be the first in 2023.

Watch out: Christmas is coming sooner than expected. The last loading opportunity this year from our central warehouse in Hamburg is 23.12.2022. After that, operations in the Hanseatic city will start again from 2 January 2023. In Italy, many suppliers close in the post-Christmas week until 8.1.2023. The first direct deliveries after the plants open will only be possible again then. In terms of delivery via Hamburg or drop shipments, we ask you to plan enough in advance and notify us in good time. Then you will be the first in 2023.