The vigorous tomato plants in Italy at the beginning of July gave us hope and anticipation. Will the 2022 harvest deliver what the view across the vast fields promises? Everyone is eagerly awaiting the red pick-me-ups ...

PMM was on the ground for you in the north and south of the country. Our contacts there reported that there are "no problems with pelati, tomato pulp and other tomato products" so far, even though the area under tomato cultivation has decreased by up to 15 %, particularly in central and southern Italy, according to the Italian association of canned food producers Anicav (Naples).

However, the anticipation is dampened by the extreme weather conditions - the weeks-long drought in northern Italy (less so in the south). Farmers are terrified of drying out even in the last few meters. But the lack of water is also putting producers in a state of alarm. They also need a lot of water for their production processes. The Italian government has just declared a state of emergency for the northern provinces. The decision will make it easier for the government to release funds and aid to combat the consequences of the drought in the affected areas. Incidentally, water shortages are also depressing the result in California, where the harvest volume is unlikely to exceed 11 million tons. Extreme water shortages and less acreage for tomato cultivation are reported from Spain. Portugal is also experiencing drought, but market experts expect the tomato harvest in 2022 to be on a par with the previous year. But one thing is certain: pizza sauce in particular is in short supply. Portugal is the most important origin for this product. However, the largest supplier of this product is experiencing enormous difficulties. The demand for the new harvest is therefore huge. Tomato paste will be "lacking at every turn", warn insiders. Despite significantly higher freight rates than two years ago, a tariff of 14.4 % and parity between the USD and the EUR, China can be an alternative when it comes to tomato paste. We would also like to thank Mutti for the trustful cooperation and reliable partnership in this tense market situation, especially in the last six months. PMM is Mutti's representative for the bulk consumer sector in Germany with over 40 products.

Conclusion 1: No surpluses from the last harvest, less raw material worldwide, high material and transport costs, and further increases in energy prices mean that all end products are becoming significantly more expensive. The result is volume cuts and allocations in contracts from new production. Manufacturers no longer want to or can bear the full risk and offer annual contracts as usual. In addition, doubts are arising in view of the economic expectations, the rising inflation figures and the renewed high incidence of corona. A seller's market prevails, the likes of which we have not seen in a long time! We all have to change and say goodbye to old habits. Those who do not want to go down this path will not successfully reach their goal this season, despite perceived market power.

Conclusion 2: We see major difficulties ahead for energy-intensive products such as tomato paste. There is a lack of raw material from Ukraine and Spain, and skyrocketing gas prices are making production increasingly uneconomical.

Conclusion 3: For the new crop, you need to break new ground and take a hard look at can versus pouch. Whether it's tomato pulp, pizza sauce or tomato paste, the advantages clearly outweigh the disadvantages, and now is a better time than ever to switch. Since, analogous to can sheet and jars, empty pouches (in all formats, by the way) are also running out of supply, bold and quick decisions are required. Inquire with us, the price difference per kilo will surprise you!

Conclusion 4: Despite the many worries, do not forget optimism and humor! We at PMM always look ahead with confidence and remain true to our guiding principles. Even in difficult times we keep a cool head and offer several novelties: Peeled tomatoes with basil (A-10 cans) in ADRIA premium quality and, as a convenience product, the finest 2×5 kg tomato pulp under the label DONNA ROSA as well as 10 kg bags of tomato paste. Last but not least, a real trendsetter will be available from the 2022 harvest: 2650 ml peeled tomatoes in extra-thickened juice with 1850 g drained weight in the brand new PAOLO ROSSI litho cans.

Conclusion 4: Despite the many worries, do not forget optimism and humor! We at PMM always look ahead with confidence and remain true to our guiding principles. Even in difficult times we keep a cool head and offer several novelties: Peeled tomatoes with basil (A-10 cans) in ADRIA premium quality and, as a convenience product, the finest 2×5 kg tomato pulp under the label DONNA ROSA as well as 10 kg bags of tomato paste. Last but not least, a real trendsetter will be available from the 2022 harvest: 2650 ml peeled tomatoes in extra-thickened juice with 1850 g drained weight in the brand new PAOLO ROSSI litho cans.

And last but not least, there is a real trendsetter from September 2022: 2650 ml peeled tomatoes in extra thickened juice with 1850 g ATG in the brand new PAOLO ROSSI litho cans.

The harvest in Greece was late and, with a total volume of about 50,000 tons, is slightly below last year. The fruits are smaller, a total of 12 factories (including manufacturers of frozen products) need and process the raw fruits. After enormous price increases for sugar, cans and energy, higher prices are now also being demanded for drums and pouches. Regardless of the kind of offer or the packaging type - the contents are bound to become more expensive. A similar price trend is also emerging for Spain where there is also less raw material available than last year.

The harvest in Greece was late and, with a total volume of about 50,000 tons, is slightly below last year. The fruits are smaller, a total of 12 factories (including manufacturers of frozen products) need and process the raw fruits. After enormous price increases for sugar, cans and energy, higher prices are now also being demanded for drums and pouches. Regardless of the kind of offer or the packaging type - the contents are bound to become more expensive. A similar price trend is also emerging for Spain where there is also less raw material available than last year.

The peach harvest in Greece is just starting and is expected to last until the end of August or even early September. For 2022, market observers expect the volume of raw material from Greece to be around 350,000T of the "Pavia" variety of peach used for industrial processing. While this is an increase of 38 % compared to last year, it is still significantly less (-12 %) compared to average crop yields from 2016 to 2020. New raw commodity prices have not yet been fixed, and initial quotations are expected when this market report is published. However, market experts expect slightly higher prices of 1-2 % due to known increasing cost factors (energy/processing/packaging). Important to know: There are virtually no unsold volumes left from the previous year, so the new crop is hitting empty markets here too (as with tomatoes).

In Spain , only 181,000 tons of the Pavia variety will be available this year (-47% less than 2021). This is a glaring mismatch between demand and supply and will result in most of the processed product going to domestic consumption. China, the world's largest origin (with an area under cultivation of about 867,000 ha for white and yellow peaches/output of raw material up to 12 million t) is only a limited alternative. The reasons: First, the weather in the main growing areas did not play along there either (drought); second, most of the produce will flow to the domestic market or to the U.S.; and third, cost increases for energy, sheet metal, packaging and transport will entail significant price increases. Due to this overall development, there is a threat of undersupply on the European market with corresponding price markups.

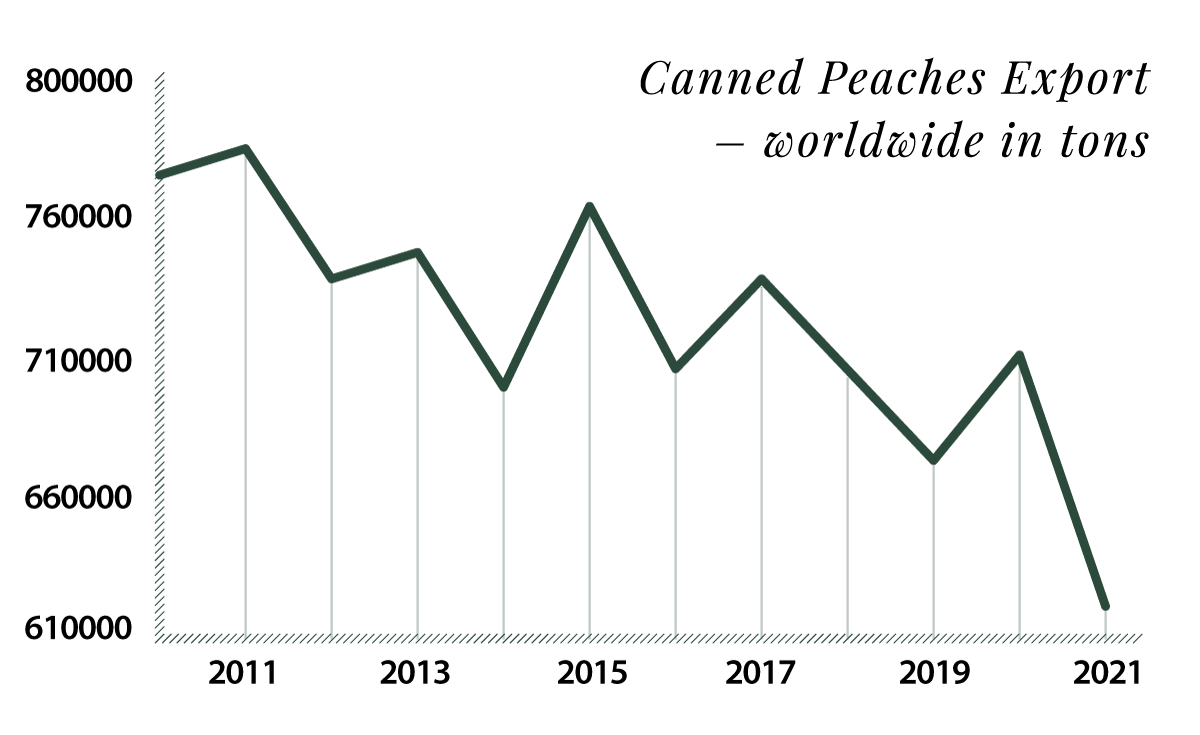

By the wayThe trade volume of canned peaches has been falling continuously since 2010 - dramatically last year from around 710,000 t (2020) to around 620,000 t in 2021 (see chart left). However, 2020 was also the first pandemic year, in which the run on canned goods was probably particularly strong worldwide. It is also interesting to note that the main importers of those 620,000 t of canned peaches last year, after the USA, were Germany and Japan.

The beginning of the harvest in Thailand was promising. In June/July, however, the volume of raw material delivered daily declined from 7000 to only 2000 t/day at last count. The price shot up to just under 7.5 THB/kg. Stocks were sold out within a very short time. In addition, the factories just closed their belts due to the legal shutdown until mid-September. After that, the winter harvest will start. The currently available supply is scarce and expensive. However, PMM was able to order in time and is currently still stocked with the best quality (pineapple slices/pieces in 3 can sizes each).

In origin Turkey normally currently taking place harvest of hot peppers and tomatoes is delayed by at least two weeks after bad weather conditions (including drought). The harvest of green peppers of the varieties Lombardi and Macedonia should be through earlier, in fact it now starts only in the second half of July. The market is crying out for it - but a lower yield is expected.

Green and red peppers have increased massively in price compared to last year. Packers are almost sold out of hot peppers and jalapeños. Red peppers (e.g., round tomato peppers (Topa), elongated pointed peppers (Kapia), and the not-so-deep reds (California Wonder)) have been planted at 50 % less, and harvest is also delayed. There are still offers for topa peppers. However, only at daily prices, as the largest empty can supplier in the Turkey daily price changes and the raw material is very volatile.

Green and red peppers have increased massively in price compared to last year. Packers are almost sold out of hot peppers and jalapeños. Red peppers (e.g., round tomato peppers (Topa), elongated pointed peppers (Kapia), and the not-so-deep reds (California Wonder)) have been planted at 50 % less, and harvest is also delayed. There are still offers for topa peppers. However, only at daily prices, as the largest empty can supplier in the Turkey daily price changes and the raw material is very volatile.

High prices have also already been identified for those industrial tomatoes that are used for tomato paste or for sun-dried tomatoes. For both products is drawn from the same pool. Due to the immense demand of tomato paste, the majority of the late harvested tomatoes will go into the production of tomato paste, report our partners in Turkey. Consequence: fewer and more expensive dried tomato products.

PMM Mr. Freccia, this year's tomato harvest is just around the corner. Fresh, ripe and tasty tomatoes lift the spirits. What is your mood?

Tiziano Freccia Every year the harvest is a surprise and different from the previous ones. In the north of Italy this year we have to deal with a heat wave and a severe drought. It affects all crops, not only tomatoes. The situation is worrying. The spring rains have completely failed and the Po River has the lowest water level in decades. We continue to hope for refreshment, but with temperatures around 30°C, there is a risk of hailstorms or flooding. We fear that due to climate change, we will now regularly experience extreme weather conditions.

PMM This crop is hitting a totally sold-out market. What harvest result do you expect? How will you ensure that demand from industry and trade can be fulfilled?

TF After two years of uncertainty related to Covid and the lockdowns, the foodservice sector is back on track. However, the market is suffering from very low inventories. For the new season, demand from industry and foodservice has been strong, especially for tomato paste. Fortunately, Casalasco can rely on 570 farms in the network. In addition, there are three processing plants with a total capacity of more than 560,000 tons of fresh tomatoes. We are convinced that only long-term relationships ensure the company's success, because they can cushion price swings and fluctuating availability of goods.

PMM What trends are emerging in the European market, e. g. with regard to the processing of raw materials or packaging?

TF The pandemic, the resulting closures, the disruption of supply chains, the rise in energy prices, climate change, the war, the difficult relations with Russia and rising inflation - all this blocks the innovation process. It should actually help us keep the product on the shelf at the best possible price. It's difficult to identify trends. This is because there is a feeling that inflation is having an impact on the assortment. It is likely that items that are not essential or beneficial to the company's cash flow will be reduced because of low sales and limited profitability.

PMM The label "100 % made in Italy" is not only a quality claim, but also means shorter delivery routes. Are customers prepared to pay higher prices for this?

TF "100% made in Italy" identifies an area and the way in which tomatoes are treated. First of all, the northern Italian region of Emilia Romagna has developed the "qualità controllata" (CQ) standard, which can be used by farms that pay attention to environmental protection and health. They are only allowed to use a limited number of chemicals at certain times and must check the freshness of the fruit before harvesting. The list of products is more restrictive than the Italian law, which is already very strict in this area. In addition, a few years ago we introduced a traceability system based on the chronological process of the tomatoes delivered to the factory and the corresponding end product. It allows us to trace the path between the end product and the farmers who supplied the batch of tomatoes. These procedures, these processes and this quality come at a price. There are customers who recognize this and are prepared to pay this higher price. Others are not, because they focus on other factors that make up a lower shelf price.

Thank you for the interview.

No results found.

Speaking of going his own way: Paul M. Müller (PMM) will take off as a new umbrella brand, under the same domain of course paulmmueller.combut with a completely new look and feel. The relaunch is currently in full swing. The service and information areas are being continuously expanded. Our popular knowledge series "PMM College" is immediately present. And it gets even better: we are positioning our brands particularly impressively under the umbrella of PMM: Our popular own brand ADRIA is making the start. You can look forward to seeing what's in store for you!

August is traditionally the vacation season in Italy, and Ferragosto (Assumption of the Virgin Mary) is also celebrated in the middle of the month (on 8/15). Especially in the week before and after (week 32-34) there will be hardly any truck shipments. Loading space is a valuable commodity in this difficult situation that has been tense for weeks anyway (fewer trucks, fewer drivers, high fuel costs). Place your next orders in time and we will take care that everything will be delivered on time!

The management of Paul M. Müller congratulates its quality assurance team (from left to right: Oliver Munz, Jacqueline Neyra Rivera de Ofner, Sonja Urban), which has just successfully passed the certification requirements for "IFS Broker" version 3.1, 2021 at Higher Level. "We are proud of our dedicated employees," say the two PMM bosses Thomas Schneidawind and Fabian Kretschmer.

Pepperoni Lombardi rings from ADRIA (can: 4250 ml) are finally available again! If you still prefer to cut the pods yourself, you are still welcome to order whole hot peppers in the best ADRIA quality (can: 4250 ml) from us. We now finally have both in stock again.

Although we rate the sources we use as being reliable, we cannot accept any liability

for the information provided here being complete or correct.

You want to tell us a story or share experiences from the industry? Do you have feedback for us? Photos or stories? We would like to invite you to actively shape the PMM Market Report, and we welcome every contribution, suggestion and criticism. THANK YOU for taking the time to read and be a part of our PMM community.

We provide you with fresh industry news and informative interviews - just enter your name and e-mail address and click on "Subscribe"!

you can reach us Monday - Friday from 7:30 - 17:00.