PMM: You are an expert on the Czech market. What can you tell us about it?

The Czech market is very price-aggressive. Czech consumers tend to buy many products during discount campaigns, especially those with a longer shelf life that are easy to store at home. 80 percent of total sales are campaigns or special offers.In certain product ranges, prices can fall by 25 to 33 percent. While German discounters such as Lidl or Aldi only reduce their prices slightly - for example from 1 euro to 95 or 93 cents - the price differences are much more pronounced here during discount campaigns.

PMM: Who dominates the market?

A large part of the market is dominated by discounters, with Lidl, Penny and Norma being the three most important players. Kaufland, which I classify as a hypermarket and discounter, and Tesco also have a significant market share. In the supermarket segment, Billa and Albert, which belong to the Dutch Albert Heijn Group, are major players.

PMM: If we look at Paul M. Müller's product range: Which foods are particularly popular with Czech customers?

Our canned fruit is very popular, especially in formatted varieties. These are particularly suitable for communal catering in large kitchens, canteens and schools. Many customers appreciate it when the canned fruit is already offered in cubes, as this eliminates the need to cut or prepare the fruit themselves. In schools, for example, children are simply given a bowl of diced pears or peaches. The products from our tomato range are also very popular. They are an important basis for many dishes. In the Czech Republic, beef with tomato sauce and tomato soup are particularly popular - and chefs use our products for this. Incidentally, we supply slightly fewer products to the food service industry, as this market is structured somewhat differently. Italian restaurants often buy their supplies directly from Italy, which makes it difficult for us to enter this sector.

PMM: What are the biggest challenges on the market in the Czech Republic?

It is very difficult to remain price-competitive, as Czech trading companies buy goods everywhere and sometimes very cheaply. One disadvantage for us is that the Czech market is relatively open to small quality defects. For example, if a product has already lost 70-80 percent of its shelf life, we can still market it relatively easily. It is certainly different in other European markets.

PMM: Could you please give us an insight into the eating habits of the Czech people?

You have to make a distinction here: It used to be common for families to eat out together in restaurants. In the past two to four years, however, prices have risen sharply - it is too expensive for many families to eat out regularly. Nevertheless, many Czech people still eat in restaurants at lunchtime, although the pricing is different here. Menus are often offered where the soup is included in the price, or there are three to four selected lunch dishes. These offers are particularly popular from Monday to Friday in the city center of České Budějovice and are still affordable for many. In general, the restaurants in the city center of České Budějovice are relatively well frequented, especially in the pubs where beer is served and there is a lively atmosphere.

PMM: Can you tell us about any other special features from the Czech Republic?

We have oriented ourselves to German standards and are currently working on new guidelines for school catering. Little has changed in this area in the last 30 years, but there is now a movement towards new guidelines. A key issue is the consideration of special dietary requirements, such as gluten-free or lactose-free options, in order to cater for children with intolerances. It is important that we develop clear guidelines on how food should be cooked for children and pupils. We should pay attention to aspects such as reduced salt, sugar and fat content and focus more on qualitative nutritional values. The nutritional value tables must also be included in the considerations so that pupils and their parents know what they are eating. We should also focus on more wholegrain products, fruit and vegetables and regional foods and reduce the use of plastic packaging. At the same time, it is important that prices remain acceptable for families, especially those on low incomes.Another aspect is the digitalization of the ordering process. At my children's Catholic school in the center of České Budějovice, they can choose from three dishes: a classic hearty meal and a lighter option or a dessert. The children can control this choice themselves via an app, which offers qualitative control and flexibility.

PMM: Does this also influence your work?

We need to make sure that our products do not contain too much sugar and possibly consider larger packaging. For example, children could be given apple sauce in bowls instead of plastic cups. Overall, these goals and guidelines are part of a broader effort towards sustainability, which is becoming increasingly important in many areas.

PMM: What do you particularly appreciate about Paul M. Müller's products?

Quality is crucial. Our complaint rate is probably not zero, but it's very close. We have no concerns that we will receive inferior goods or that something will go wrong. If there are still quality defects, this is communicated and a solution is found.We also appreciate the service, especially the communication regarding specifications, sample shipments and market overviews. The standard we experience here is consistently very good.

PMM: Are there any products that your customers would like to see in the Paul M. Müller range?

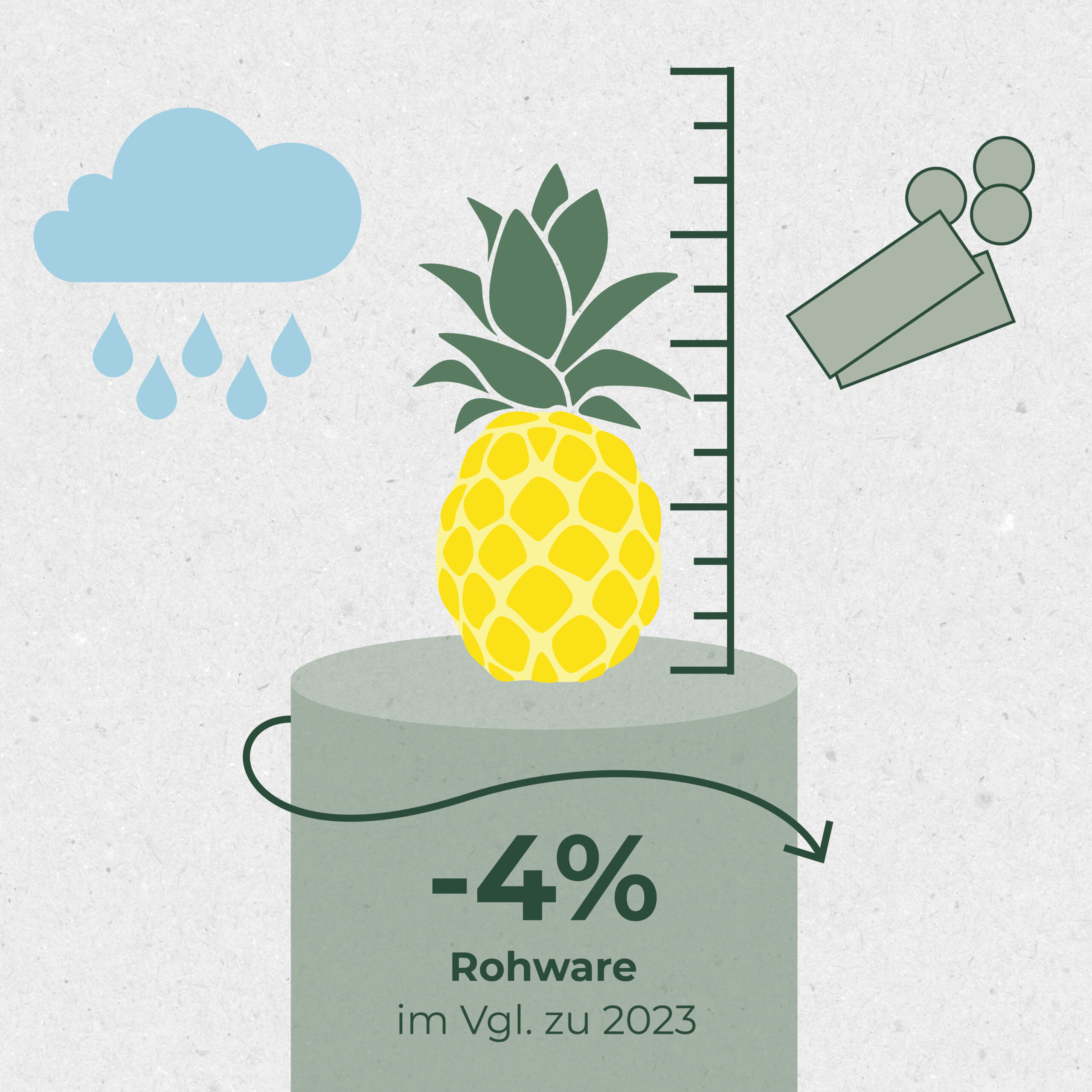

Yes, we see potential in the canned fruit sector in particular. However, it is a challenge to procure European fruit varieties. For example, it was extremely difficult to get cherries, as availability is very volatile - sometimes there are too many, sometimes none at all. We also see problems with Asian products, as availability is uncertain and prices can often rise sharply. In addition, a product that has minor defects could be quite attractive, especially if it is offered at a lower price. This makes it easier for us to compete with our competitors.

About the person - Stanislav Štádler

Stanislav Štádler is the father of three children and lives in České Budějovice. After studying at the Business Academy in České Budějovice, he worked for several years in various professions - in a hotel, in a tourism information center and in the medical equipment trade. From 1995, he was sales manager at EFKO, an Austrian producer of sour vegetables. He then became managing director at Machland, a subsidiary of EFKO. In 2008 he founded his own company Keystone Value.